A to Z of Leasing and Asset Finance

Third edition published October 2024

Comprehensive guide to the terminology of the asset finance market. In this revised and expanded third edition, over 450 terms are described with insight and precision. Terms are linked to themes such as accounting, assets operations and risk, allowing a particular topic to be studied.

Available from Amazon and other booksellers, or direct from Asset Finance Policy, usually with next-day delivery.

£35 (discounts available for multiple copies ordered directly)

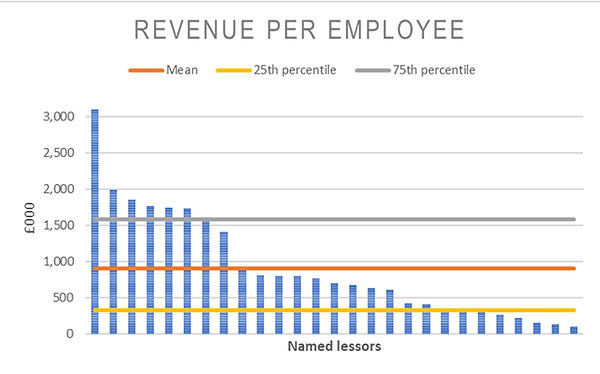

UK asset finance industry financial benchmarking

Bespoke analysis available to cover any UK asset finance firms, allowing benchmarking of firm size and efficiency. Metrics include:

-

Impairments as a precentage of book

-

Cost of funds

-

Margin

-

Staff cost

-

Staff efficiency

-

Return on book

-

Return on equity

The analysis is based on publicly available sources, where appropriate consolidating relevant group entities.

Asset finance industry training

In-person or online training options include:

-

Fundamentals of Asset Finance (delivered for Intuition training)

-

Overview of FCA compliance for asset finance brokers

-

Role of accounting data in asset finance underwriting

-

FCA compliance for brokers including Treating Customers Fairly, Consumer Duty and vulnerable customers

Annual lender and broker ranking surveys

Annual surveys published jointly with Asset Finane Connect:

-

Asset Finance 50: Top UK business equipment and auto lessors

-

Asset Finance Europe 50:Top European business equipment and auto lessors

-

Broker 30: Top 30 UK business asset finance brokers

Data is all taken from publicly available sources, together with clearly set out estimates. Lessor size is measured by net receivables, broker size by estimated annual originations.

Available for free download from www.assetfinanceconnect.com

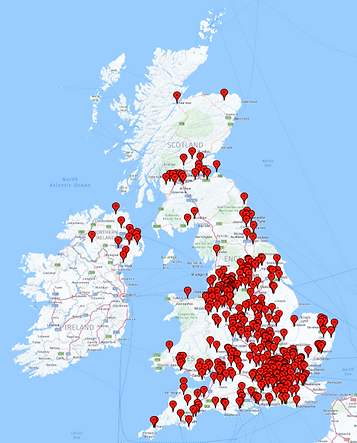

Asset finance broker directory 2025

This is the only comprehensive directory of UK asset finance brokers. It includes around 460 firms, comprising both asset finance specialists and other commercial finance broking firms known to have asset finance specialist brokers.

The Excel directory provides website and postal addresses, telephone and email contacts. It is checked and updated quarterly.

£950 plus VAT.